Background

Blockchain is the most recent IT development in a chain of developments over the last 25 years.

Blockchain is the use of three technologies:

- Internet

- private key cryptography

- a protocol governing incentivization

that creates a secure system for digital interactions without the need for a trusted third party to facilitate digital relationships (‘trustlessness’).

In its essence, the blockchain is a change-resistant database that allows only for new information to be added to it. It’s impossible to change previously written information, without rewriting every Block once incorporated into the structure of the blockchain. Because of this, Bitcoin transactions for example are in themselves secure (although theft of tokens, fraud and market ‘pump and dump’ manipulation have become rife. Since the Bitcoin blockchain is publicly available, one could theoretically trace back all of the transactions to the very first transaction ever made.

There are 4 components to a Blockchain:

Hash

- The blockchain relies on cryptography, and in the case of Bitcoin, the method used is SHA-256. This is a one-way hashing function, which means that it can’t be decrypted. It’s used as a way to cross-reference information, where the hashes themselves can be used to prove work and Bitcoin ownership.

- The hashes for Bitcoin transactions and mining are different. Bitcoin transactions are stored in the Blocks, while Block headers are hashed by the mining processes.

Blocks

- These are the building blocks of the distributed ledger. They contain all the information regarding transactions, such as the total number of transactions, block height, a timestamp as well as hashes for the previous, following and the current block.

- Blocks are created through the mining process.

Blockchain

- Once you understand what a block is and how it works, you can imagine a string of blocks. This string relies on the previous block and their specific hashes to validate the information. By checking and relying on the previous hash, it provides the layer of security that everybody in the Bitcoin community swears by.

- Combined with the ingrained hash requirements determined by the mining difficulty (proof of work), this method ensures the correct transactional history of the ledger

Distributed Ledger

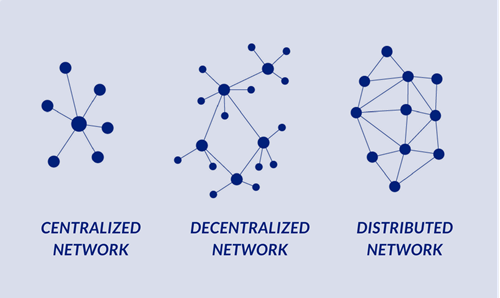

- The blockchain is also a distributed ledger, which is another feature that further adds to the security of Bitcoin transactions. This means that the database, which is the blockchain is stored across a network of computers. Each of these computers stores the exact same copy of the database and the network itself continually cross-references the data between other copies.

DLT is a protocol for building a replicated and shared electronic ledger system, collectively maintained by the participants in that system or network, rather than by one central party. In a DLT system, each network participant constitutes a ‘node’ or, more exactly, the nodes comprise the individual participants’ computers, each of which contains a complete set of transaction records (i.e. the ledger). Taken together, the nodes constitute and maintain the distributed ledger.

It is important to be clear about the difference between DLT and tokenisation.

- DLT is an IT protocol for creating a block of digitally recorded and encrypted records of data.

- Tokens are virtual currencies which are issued by companies to raise money

Specifically:

- A distributed ledger is an immutable database that is governed by a predetermined set of rules, consensually shared and synchronised across multiple sites, institutions or geographies. It enables untrusting parties with common goals to co-create a permanent, immutable and transparent record of exchange and processing, while making the database more secure and resilient.

- Blockchain is really just a sophisticated ledger system. It is a versatile technology that can record financial transactions, store medical records, or even track the flow of goods, information, and payments through a supply chain.

- While it can provide more security and, in some cases, anonymity, the truth is that on its own, blockchain doesn’t actually do anything unless it is paired with a solid use case where it can serve as a sort of Trust-as-a-Service (TaaS) to ecosystem participants. Ultimately, it’s more of a business model enabler than a technology.

There has been a huge increase in the last two years in the use of Blockchain as a method of managing climate change related projects and activities and using tokenisation capital raising for financing projects. With the recent EU developments of the Sustainable Finance initiative and the Border Carbon Adjustment Mechanism the use of Blockchain and tokenisation looks very likely to expand even further.

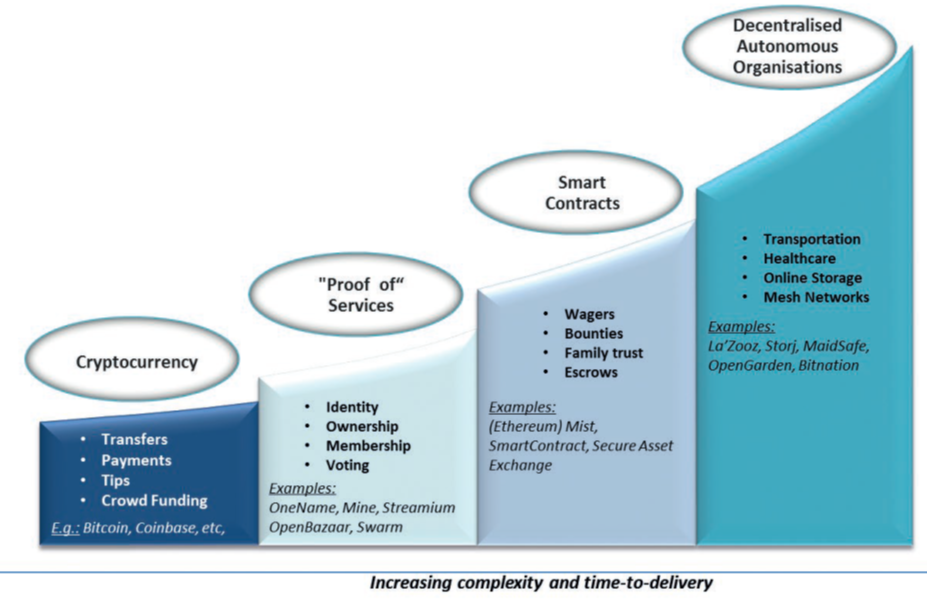

Key Blockchain applications groupings:

DLT application for energy and environmental assets

Many energy and climate related coins have already been launched. Thus, there already is the beginnings of a market in trading such tokens. Building on this emerging market, a DLT Energy and Environmental trading platform would allow any token relating to:

- energy (principally oil, gas, electricity in a national market and specifically but not exclusively renewable electricity and biogas)

- emissions reductions, being voluntary or compliance carbon credits or emissions allowances to be traded. It will also allow:

- trading of energy and emissions token crosses

- trading of tokens against fiat currencies

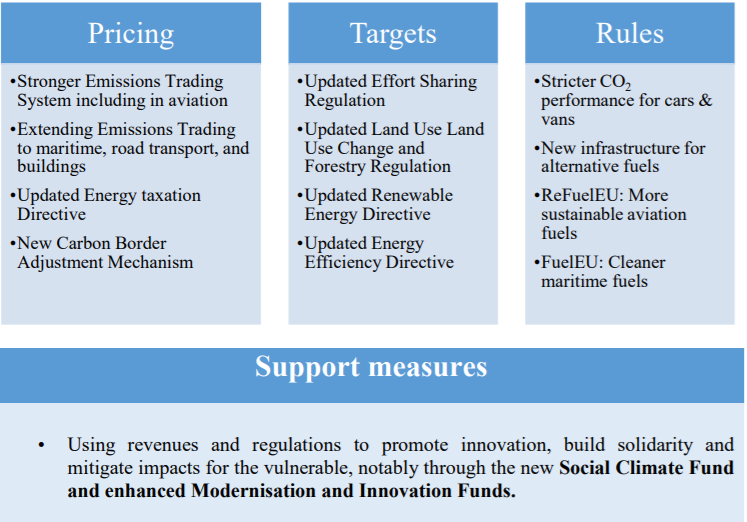

In July the EU committed to cutting greenhouse gas (GHG) emissions by 55% by 2030. The Fit for 55 plan covers the following:

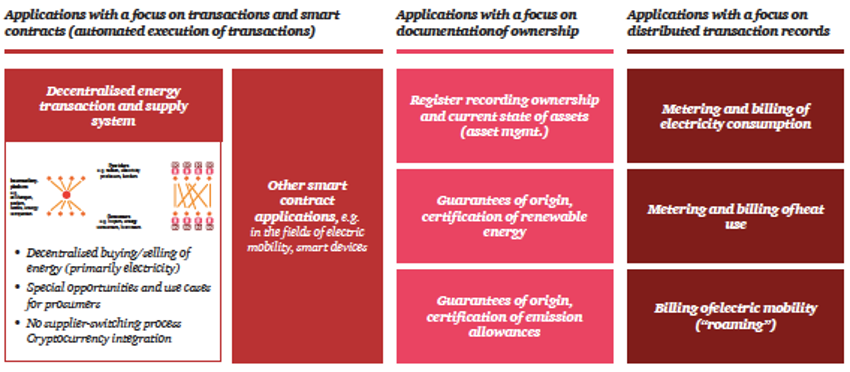

Overview of possible Blockchain case uses in the energy sector:

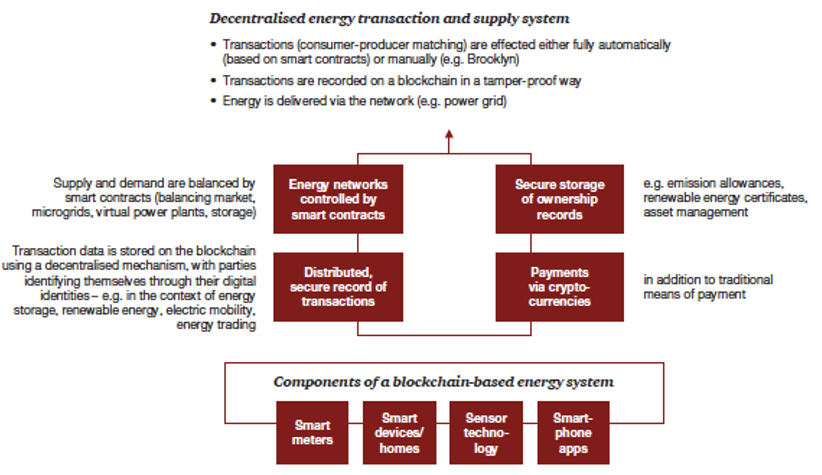

Cornerstones of a decentralised energy transactions and supply system:

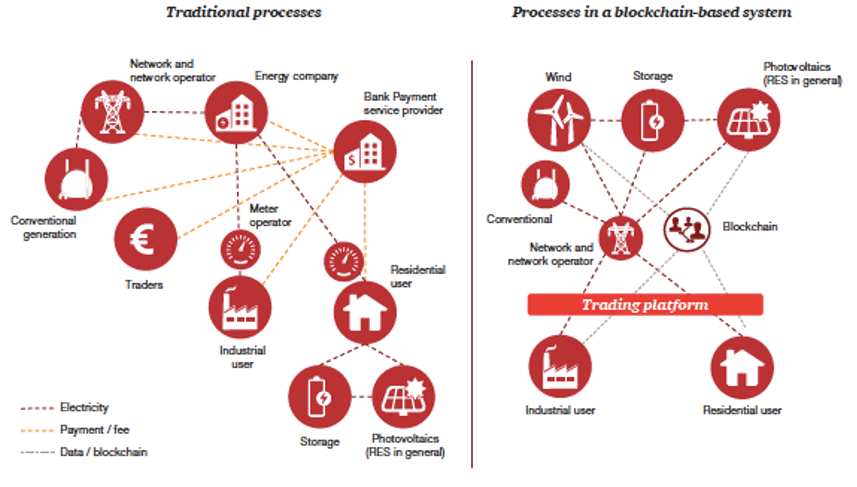

Transformation of market structures under decentralised Blockchain model:

Examples of current use of Blockchain in energy & climate applications

We can consider three areas in which Blockchain is currently being used to help to combat climate change:

reating markets for carbon removals and offsets

- creating a market for climate data

- using crypto to finance climate projects

Creating markets for energy, carbon removal and carbon offsets

GridPlus Energy is a retail electricity provider offering residential power consumers affordable prepaid and post-paid energy plans in deregulated areas in Texas.

Brooklyn Microgrid is an energy marketplace for locally-generated, solar energy in NYC which allows prosumer residential and commercial solar panel owners to sell the excess solar energy they generate to city residents who prefer using renewable energy

Electrify Marketplace was designed for the deregulation of Singapore’s energy market to provide residential, commercial and industrial consumers with P2P trading

Restartenergy is a Romanian company utilising Blockchain in utility switching in electricity & gas markets

1Planet by Carbon Futures enables individuals and organizations to support carbon offset projects. If you’re a merchant, you can leverage 1Planet to integrate offsets into your checkout process. They’re tokenizing the carbon offsets (1PL).

Climatebase / NCX (Natural Capital Exchange) is a data driven forest carbon exchange

Cascadia Carbon is selling NFTs associated with trees that are being planted.

Corcovado is similarly selling NFTs associated with trees that are being planted. However, each NFT will also generate a fungible token (CORCOCOIN) each year after the tree is planted.

Moss.Earth has created a token (MCO2) that is tied to carbon credits resulting from the protection of the Amazon rainforest.

Nori has created a blockchain-based marketplace for buying and selling the removal of carbon from the atmosphere. They have focused on actual removal of carbon from the atmosphere, and blockchain just happens to be how they solve the double-counting problem. You could use Nori without knowing a thing about blockchains. A token issue is scheduled for later this year.

Pachama, though not built on a crypto foundation, are using technology to make it easier to monitor efforts to reforest and avoid deforestation, and they are playing an important role in scaling up the availability of offsets. Probably they will move to a crypto activity.

RECDeFi, a signatory to the Crypto Climate Accord, has yet to launch. It aims to create a decentralized marketplace for trading environmental commodities (carbon offsets, renewable energy credits, etc.).

Regen Network is creating a marketplace for carbon offsets tied to regenerative land management, and they’re taking a relatively decentralized approach. They’ve set up a non-profit, they’re encouraging participation from DAOs, and they’re actively working on the problem of how to create bridges between ledgers. They’ve issued Regen Network tokens via private sale and expect to sell to the public in the next few months.

UPCO2 is a token tied to REDD+ carbon credits which have been verified according to standards set by Verra. Created by the Universal Protocol Alliance and overseen by its Carbon Foundation, this token is in circulation, albeit at low volumes.

Zero Carbon Project is trying to lower the cost of carbon-neutral energy by creating a competitive marketplace where buyers interested in carbon-neutral energy can bid on bundles of energy and carbon offsets. There’s also a token (ZCC) which energy providers have to use in order to settle contracts and which buyers earn as rewards when they make purchases. The bet is that the value of these rewards will rise, since the supply is capped and energy providers have to use them in order to participate in the network.

Creating a market for energy & climate data

Power Ledger is an operating system for new energy markets enabling tracking and trading of energy, flexibility services and environmental commodities.

dClimate is creating a decentralized marketplace for climate data, forecasts, and models. Just raised $3.5 million in a seed round.

OS-Climate similar to dClimate, are trying to create a marketplace for climate data. Though they’re using an open source framework, they’re not building on a blockchain foundation. The competition between dClimate and OS-Climate may help shed light on an interesting question that is mostly unrelated to climate — whether blockchain is ready to support info services businesses.

Using crypto to finance climate projects

WePower aims to finance renewable energy production by enabling developers to raise capital by selling their energy production upfront in the form of tradeable Smart Contracts

Energi Mine develops products in the energy management sector utilising AI and blockchain technology and sells EnergiTokens (ETK)

Blockchain for Climate Foundation is creating infrastructure to support the implementation of the Paris Agreement; specifically, the hope is to use NFTs as a tool for tracking and transferring emissions reductions at the country level.

InterWork Alliance is working to get alignment on offset standards, which — if it happens — will likely accelerate tokenization of offsets.

Open Earth Foundation describes itself as working on an open financial framework that aims to reduce friction when people want to invest in projects that combat climate change. They also are the beneficiary of a recent Beeple auction

Conclusion

The use of Blockchain for energy & carbon asset management and trading and tokenisation for capital raising is already well established, and we predict it will grow enormously in the energy and climate sector in the very next few years. We will be working together with UGR Laboratorio de Ingenieria para el Desarrollo Sostenible (lids) on the use of Blockchain and cryptos for sustainable development of projects in Spain and from Spain, internationally.